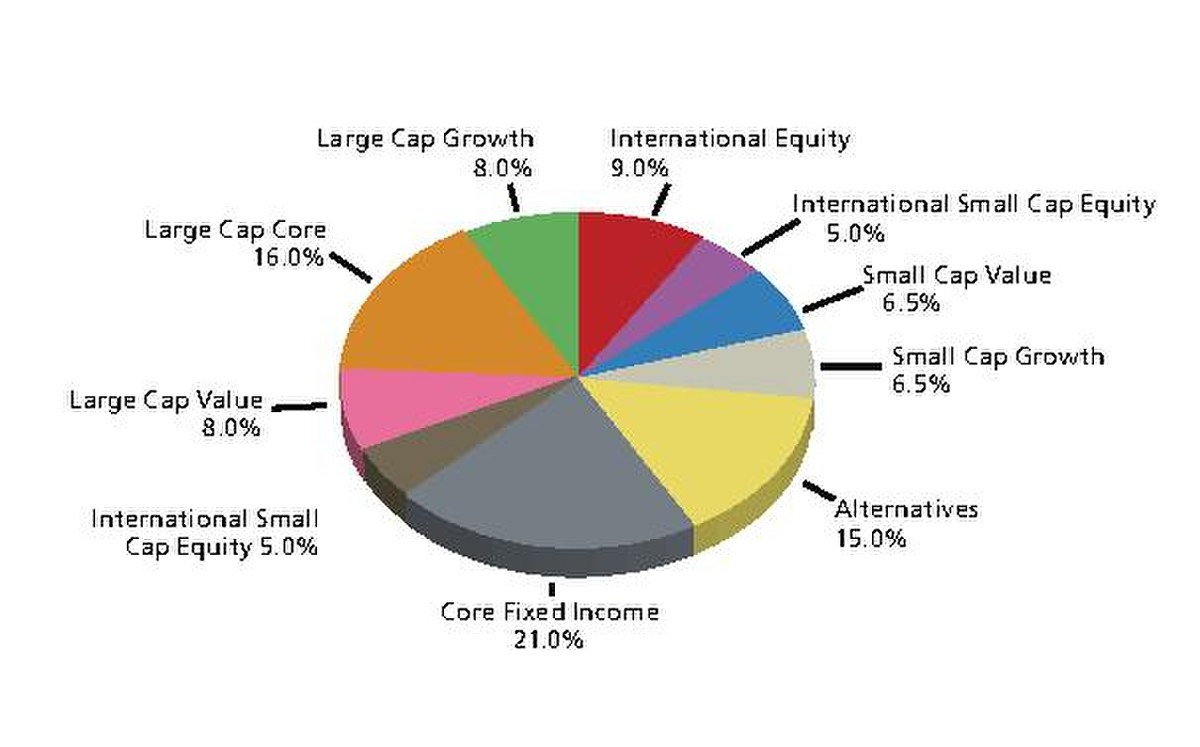

nvesting in the stock market is a way to accumulate wealth. And once you have dipped your hands into the ocean of investing, the next logical step is to reduce the risk of losing your investment. And how to do that? One method is diversification.

By diversifying, you are putting your money into various types of assets, so if one asset falls, the loss is offset by the other assets that have not been affected.

You can reduce the overall risk associated with your investment portfolio through strategic and careful diversification.

Benjamin Graham, widely considered Warren Buffett’s mentor, delved into the merits of diversification in his best-selling book “The Smart Investor” (1949).

“There is a close logical connection between the concept of margin of safety and the principle of diversification.”- Benjamin Graham

Sir John Templeton also believed in diversification and rightly said: “Diversify. In stocks and bonds, as in many other areas, safety lies in numbers.”Let’s follow this appropriate adage and learn how to diversify your stock portfolio.

Why diversify?

The goal of diversification is to achieve an optimal risk/return ratio. Its objective is to reduce the volatility of the portfolio despite market fluctuations in both directions, up or down.

What are the different types of portfolio diversification?

Through the Deadlines

Take into account the time range in which an investment operates when making your decision. Due to their higher inherent risk, long-term bonds can sometimes offer higher rates of return; however, short-term investments are more liquid but offer lower returns. The overall duration of the investment maturity of the portfolio also favors diversification.

For example, if you have a 10-year fixed deposit, the liquidity aspect would be the most affected because your money will be restricted until the end of this period. Of course, you can withdraw money at any time before the due date, but you will be charged a fee and you will receive much less money than if you had waited.

While diversifying your investments by choosing fixed deposits with different maturities, such as 2, 3, 5 or 10 years, will protect you from the liquidity factor.

Between Asset Classes

Portfolio diversification across asset classes refers to the distribution of your investments across various asset classes, such as stocks, bonds, gold, silver, mutual funds, and fixed or recurring deposits.

Depending on the broader macroeconomic situation, various asset classes react in different ways.

Alternative assets are an emerging asset class that goes beyond the purchase of stocks and bonds.

Real estate, cryptocurrencies, commodities, precious metals and other assets are now easy for investors to invest in, thanks to advancements in digital technology.

Beyond the Borders

The geographical location of a portfolio is crucial to its diversity. You can take advantage of currency exchanges by investing in shares or assets of one or more nations if the rules allow it.

You can also invest in real estate abroad. Political, geopolitical and international challenges have a greater impact on the policies of large nations.

However, the monetary policies of different countries will affect opportunities and peril in different ways. Therefore, regional portfolio diversification helps you to gain advantages and reduce risks.