If you are looking to achieve financial freedom before the traditional retirement age (60 and over), you need to generate passive income. This article will highlight the best passive income investments in our current economic environment.

Passive income is the holy grail of personal finance. If you have enough passive income to cover the desired lifestyle, you are finally free! You can say and do whatever you want. Too many people do not live their truth for lack of passive income.

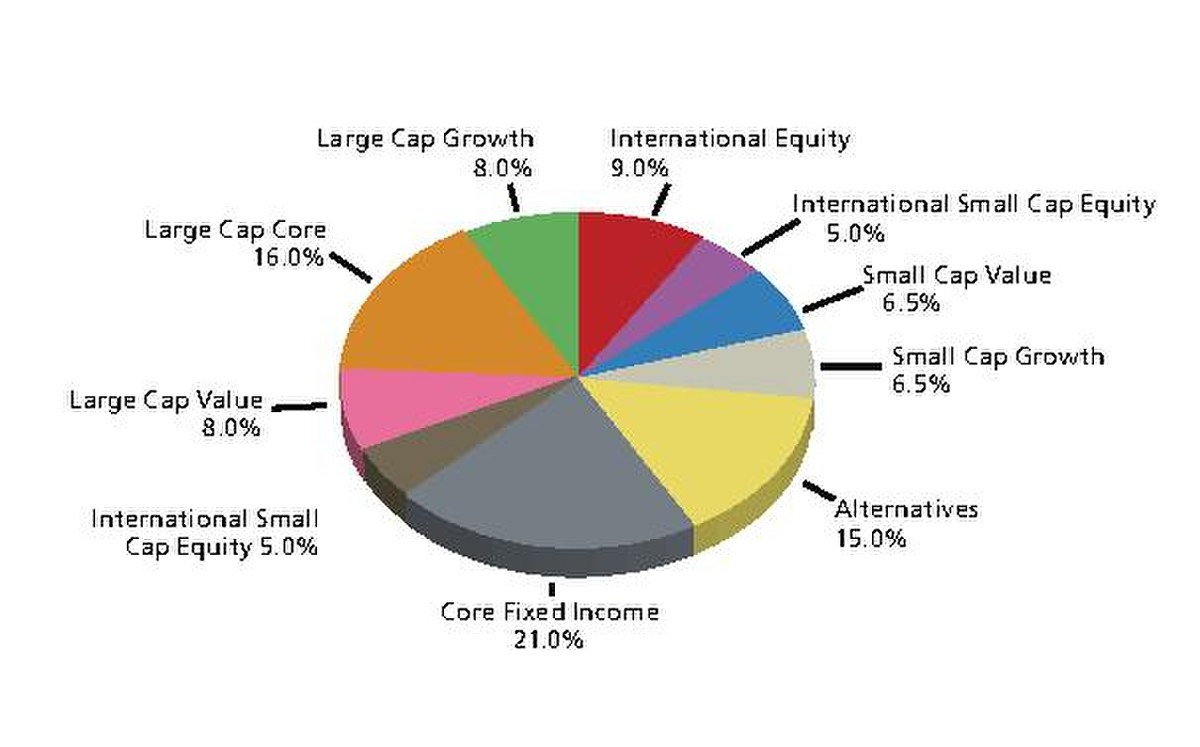

However, the only way to generate usable passive income is to create a taxable investment portfolio, including real estate investments, alternative investments, etc.

Maximizing your 401(k), IRA and Roth IRA are great moves. Unfortunately, in most matters they cannot generate passive income to live until they reach the age of 59.5. When it comes to achieving financial freedom, the hope is that we will achieve it as soon as possible because our time is limited.

In the background, I have been generating passive income since 1999, when I got a job at Goldman Sachs. In 2009, I helped launch the FIRE movement to help people achieve financial independence sooner. In 2012, I retired from finance with a net worth of about million and a passive income. I haven’t returned to full-time work since.

Why I Focused On Passive Income Generation

After about the thirtieth consecutive day of working more than 12 hours a day and having rubber chicken dinners at our company’s free cafeteria, I decided that I had had enough. Working in investment banking used to exhaust me. I needed to generate more passive income to free myself.

There was no way I could last more than five years in a pressure cooker environment like Wall Street. Therefore, I started focusing on passive income generation in 1999.

However, it was only with the financial crisis of 2008-2009 that I became passion with generating passive income. The previous financial crisis made working in finance not fun. I am sure that many people also feel the same way about their professions during the global recent times.

It was only in 2012 that I generated enough passive income to free myself from work. And it was only in 2017 that I was able to generate enough passive income to take care of a family.

Today, I estimate that my wife and I will generate about in passive income. We were on track to earn in passive income, but we blew it after buying a real forever home in 4Q2023. As a result, after 12 years of financial independence, we are technically no longer financially independent because our annual expenses are slightly higher.

However, we believe that the best time to have the best house you can afford is when you have children. And since both children are attending school full-time from September 2024, it would be nice to earn an income from part-time active consulting to keep themselves busy for 20 hours a week. I can’t play tennis and pickleball all day!

We have already explained how to start generating passive income for financial freedom. Now I would like to classify the different passive income streams according to risk, return, viability, liquidity, activity and taxes.

I am updating my passive income ranking for 2024+ because a lot has changed since my initial passive income ranking was published in 2015. A key difference in my ranking of the best passive income investments is the inclusion of taxes as a new ranking variable. After all, tax treatment can significantly affect returns.

The Best Passive Income Investments Start With Savings

By far the most important reason to save is to be able to have enough money to do what you want, when you want, without anyone telling you what to do. Financial freedom is the best!

Sounds good, doesn’t it? I wish there was a formula or a chart like the 401k by age chart that would give people pointers on how much to save and for how long to achieve financial freedom.

Unfortunately, saving money is only the first step to generating passive income. It is even more important to know how to invest your savings correctly.

If you can max out your 401k or max out your IRA and then save more than 20% of your contribution after taxes and after retirement, good things really start to happen. The ultimate goal that I recommend is that everyone strives to save 50% of their after-tax income or more.

It is your taxable retirement portfolio that will allow you to retire early and do what you want. Because it’s your taxable retirement portfolio that’s spewing passive retirement income.