At The College Investor, we want to help you manage your finances. For this purpose, many or all of the products presented here may come from our partners who compensate us. This does not affect our ratings or reviews. Our opinions are our own. All investment information provided on this page is for educational purposes only. The university investor does not provide investment advice or brokerage services, nor does he recommend the purchase or sale of certain stocks, securities or other investments.

Money Pickle is a financial advisor matching service.

The relationship between you and your financial advisor can be critical to your long-term financial success. Unfortunately, too many investors are being matched with the wrong type of advisor for a number of reasons. Maybe you found a consultant through a friend or a hunch.

Money Pickle believes that finding a financial advisor that fits your individual situation should be a convenient, fast and free process. Moderna: technology to match individual investors with trusted financial advisors. In this comprehensive review, we explain how the Money Pickle process works.

What is money pickle?

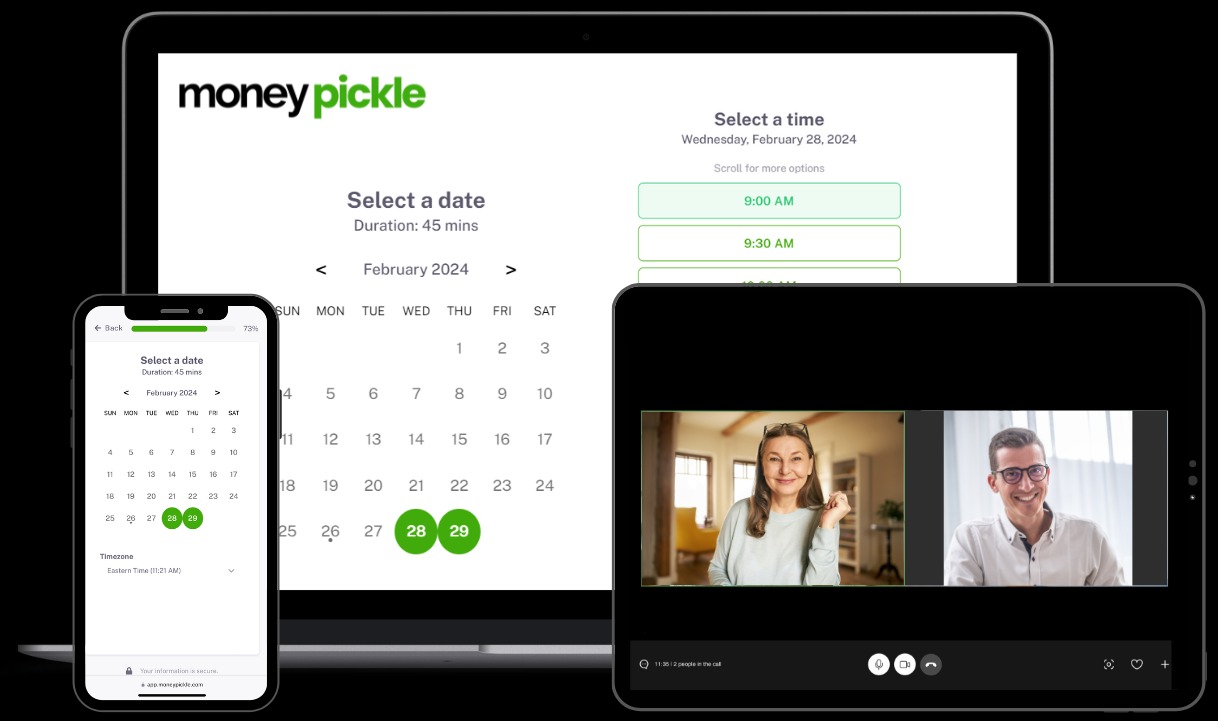

Money Pickle is an online platform that connects people with verified financial advisors. These advisors should be comfortable providing high-quality financial advice via Money Pickle’s 1:1 video conference format, and the advisor is responsible for covering the costs. Consultants benefit from the opportunity to meet potential clients. There is no obligation for the individual to become a client of the consultant.

What are you offering?

Money Pickle uses technology to connect people with vetted advisors at no cost to the investor. Here’s a closer look at how the process works.

Proper survey

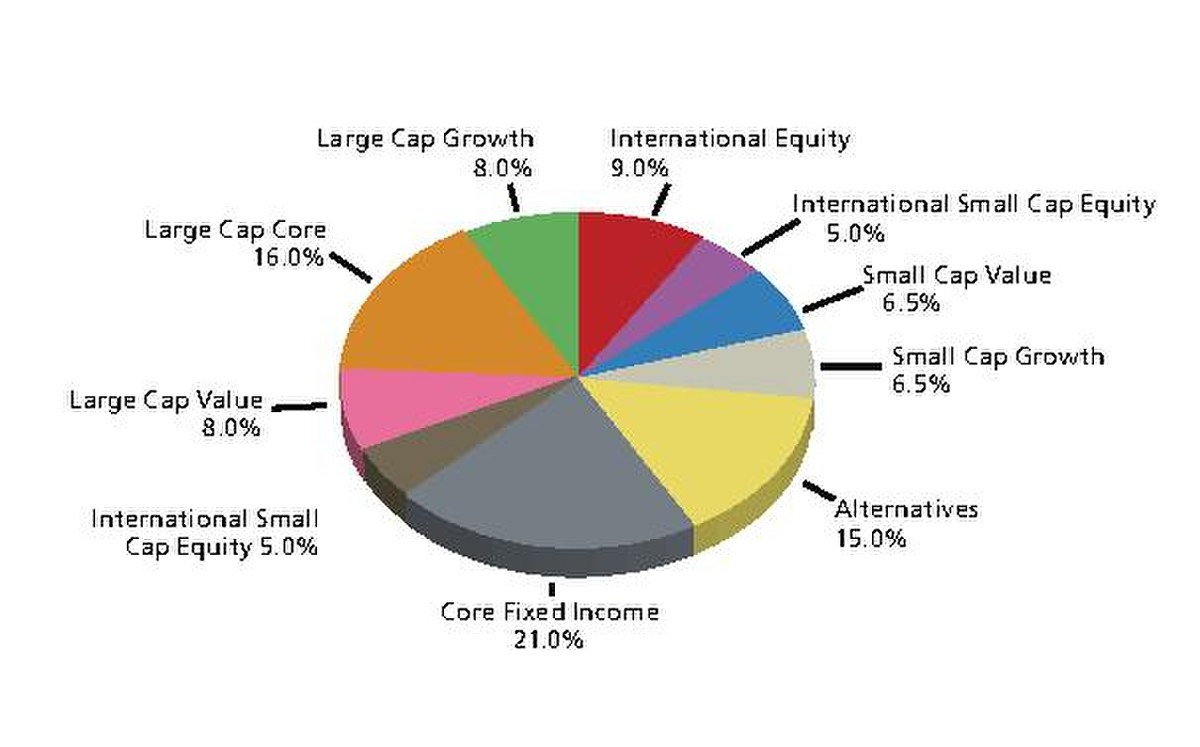

The search for a compatible consultant starts with a short questionnaire, which can be accessed from the homepage of the Money Pickle website. You will be asked for basic information, such as your age (one of a series), the financial topics that interest you most, such as general finance, retirement, investments, estate planning, etc., your annual income, the types of investments you currently have and the approximate size of your portfolio. You will also be asked if you prefer a consultation by video chat or phone call.

Schedule

As soon as you have completed the first survey and provided your email address and phone number, you will have the opportunity to book a preferred appointment on the Money Pickle secure online calendar. To help you find the best possible combination, Money Pickle will ask you some more qualifying questions. For example, you’ll want to know what type of investor you consider yourself: conservative, moderate, or aggressive, whether you’re looking for a one-time meeting or a long-term relationship, and whether you’d like to discuss estate planning at your meeting.